Email marketing is one of the most effective ways for financial advisors to connect with clients. It allows you to reach out to prospects, stay in touch with current clients, and build lasting relationships. If you want to improve your communication and grow your financial advisory business, email marketing should be at the top of your strategy list.

This article will guide you on how to use email marketing effectively for your financial advisory business. We’ll cover the basics, give tips, and offer practical advice on creating successful email campaigns that engage your audience and build trust.

Why Email Marketing for Financial Advisors?

For financial advisors, trust is everything. Your clients rely on your expertise to help them make important financial decisions. Email marketing for financial advisors helps build that trust. It lets you maintain regular communication with your clients, share useful insights, and keep them informed about your services.

With an average ROI of 4,400% (according to the Direct Marketing Association), email marketing provides a significant return on investment. It is especially useful for financial advisors who need to stay in touch with their clients without overwhelming them.

The Basics of Email Marketing for Financial Advisors

To use email marketing successfully, start by building a list of qualified leads. A solid email list allows you to communicate with the right people, those who are genuinely interested in your services.

1. Build a High-Quality Email List

Start by collecting email addresses from people who have shown interest in your services. Use your website, social media, and events to encourage people to subscribe to your newsletter. Offer incentives like free consultations, financial guides, or resources in exchange for email sign-ups.

Here are some effective ways to build your email list:

- Website Sign-up Forms: Place a sign-up form on your homepage and at the end of blog posts.

- Free Resources: Offer free financial tools, e-books, or webinars to encourage people to sign up.

- Events: Gather emails during workshops, webinars, or client meetings.

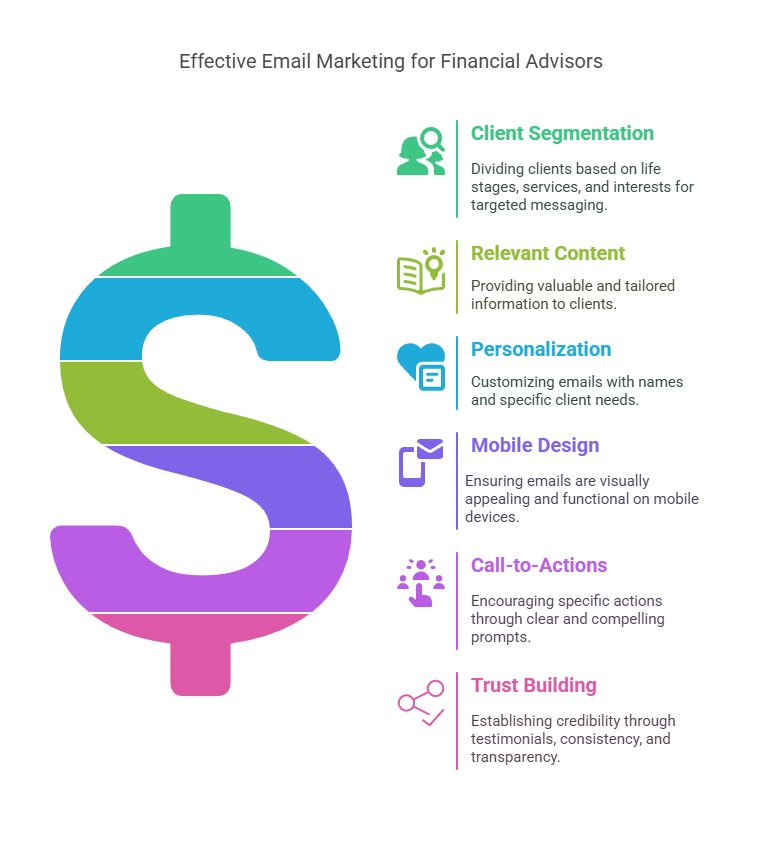

2. Segment Your Email List

Not all your clients need the same information. By segmenting your email list, you can send more targeted messages. For example, clients who are saving for retirement might want different advice than those who are planning for taxes. By sending relevant content to the right people, you increase the chances of engagement.

You can segment your list based on:

- Life Stages: Young professionals, retirees, or families.

- Services Used: Investment, retirement planning, or tax advisory.

- Interests: Tax-saving strategies, market trends, or estate planning.

3. Craft Relevant and Value-Driven Content

People don’t want to read emails that are too salesy. Instead, offer them value. For example, you could send tips on managing personal finances, updates on the market, or new tax laws. Providing valuable content builds trust and encourages clients to open your emails.

Types of emails to send:

- Educational Content: Share financial tips, retirement advice, and market insights.

- Newsletters: Keep your clients updated on changes in the market or your services.

- Personalized Offers: Send exclusive offers or consultations for specific needs.

4. Personalize Your Emails

Personalization is key to effective email marketing. Use the recipient’s name and tailor content based on their interests or previous interactions with you. The more personalized the email, the more likely it will be opened and acted upon.

Example:

- “John, here’s a financial plan we think would work well for your retirement.”

- “Sarah, check out our latest tax-saving tips for families.”

Personalized emails show your clients that you care about their specific needs.

5. Design Mobile-Friendly Emails

Many people check their emails on their phones. Ensure your emails look great on all devices. Use a clean layout, large fonts, and clickable buttons. This makes it easy for your readers to engage with your content, no matter where they are.

6. Use Strong Call-to-Actions (CTAs)

Every email should include a clear call-to-action (CTA). A CTA tells the recipient what you want them to do next. For financial advisors, common CTAs include:

- Book a Free Consultation

- Get Your Free Financial Plan

- Sign Up for Our Webinar

- Download Our Guide to Tax Planning

Make sure your CTA stands out and is easy to follow.

Building Trust Through Email Marketing

As a financial advisor, your most important goal is to build trust with your clients. Email marketing for financial advisors can help you achieve this by delivering reliable, useful information directly to your audience. Here’s how to build trust through email marketing:

1. Share Testimonials and Success Stories

One way to build trust is by showing your success. Share client testimonials or case studies that demonstrate how your advice helped someone improve their financial situation. This helps potential clients feel more confident in your abilities.

2. Consistency is Key

Consistency builds credibility. Sending regular emails shows your clients that you are present and available. You can send weekly, bi-weekly, or monthly emails, depending on your audience’s preferences.

3. Be Transparent and Honest

Your clients rely on you for sound advice. Be transparent in your emails about market trends, your services, and any fees associated with your advice. Clients value honesty and transparency, and it will help build a long-lasting relationship.

Types of Emails Financial Advisors Should Send

Financial advisors should not only send promotional emails but also provide useful information. Here are some examples of emails that work well for financial advisors:

1. Welcome Emails

Send a welcome email when someone joins your email list. Thank them for subscribing and let them know what to expect. You can also include a free resource or consultation offer in the welcome email.

2. Educational Newsletters

Share your expertise through educational content, such as market updates, tax-saving tips, or advice on investments. Your goal is to position yourself as a trusted expert in your field.

3. Event Invitations

Invite your clients to webinars, seminars, or workshops. Use email to promote upcoming events where clients can learn more about financial planning.

4. Personalized Offers

Send personalized offers based on your client’s interests. For example, if a client is nearing retirement, you can offer them a retirement planning consultation.

5. Follow-up Emails

Send follow-up emails after a consultation or meeting. Summarize what was discussed and offer additional resources or support.

Common Mistakes to Avoid in Email Marketing for Financial Advisors

Even with the best intentions, mistakes can happen. Here are some common mistakes financial advisors should avoid in email marketing:

- Sending too many emails: Avoid overwhelming your clients with too many emails. Send only valuable content at a reasonable frequency.

- Using a generic approach: Each client is different. Personalize your emails based on client segments.

- Ignoring mobile optimization: Many clients check emails on their phones, so ensure your emails are mobile-friendly.

- Not having a clear CTA: Every email should tell the reader what action they should take next.

- Lack of consistency: Consistent communication helps build trust. Stick to a regular schedule for email campaigns.

Measuring Success in Email Marketing

To see if your email marketing efforts are paying off, track key performance metrics:

- Open Rate: This tells you how many people opened your email. A higher open rate means your subject lines are effective.

- Click-Through Rate (CTR): The percentage of people who clicked on links within your email. A higher CTR means your content is engaging.

- Conversion Rate: The percentage of people who completed the desired action, such as booking a consultation.

- Unsubscribe Rate: Keep track of this to make sure you’re not sending too many emails.

Conclusion

Email marketing is a powerful tool for financial advisors to build trust, connect with clients, and grow their business. By sending valuable, personalized content and using automation, you can improve your client relationships and increase bookings. Focus on providing useful information, creating trust, and being consistent with your communication.

If you’re ready to start using email marketing for your financial advisory business, begin by creating a solid email list, segmenting it effectively, and delivering the content that your clients need. Email marketing is an ongoing process. Be patient, track your results, and always improve your approach.

FAQ

-

How often should I send emails as a financial advisor? It’s best to send emails once or twice a month, depending on your clients’ preferences.

-

What should be included in a financial advisor email? Include educational content, personalized offers, updates on market trends, and event invitations.

-

How can I grow my email list as a financial advisor? Use your website, social media, and free resources to encourage email sign-ups.

-

What’s the best way to segment my email list? Segment by life stage, services used, or specific interests related to financial planning.

-

What’s the most important metric to track in email marketing? Open rates and click-through rates are crucial for measuring the success of your email campaigns.